About PAL

1 Pension Fund Administration and lnvestment before Integration of Employee Pension Plans

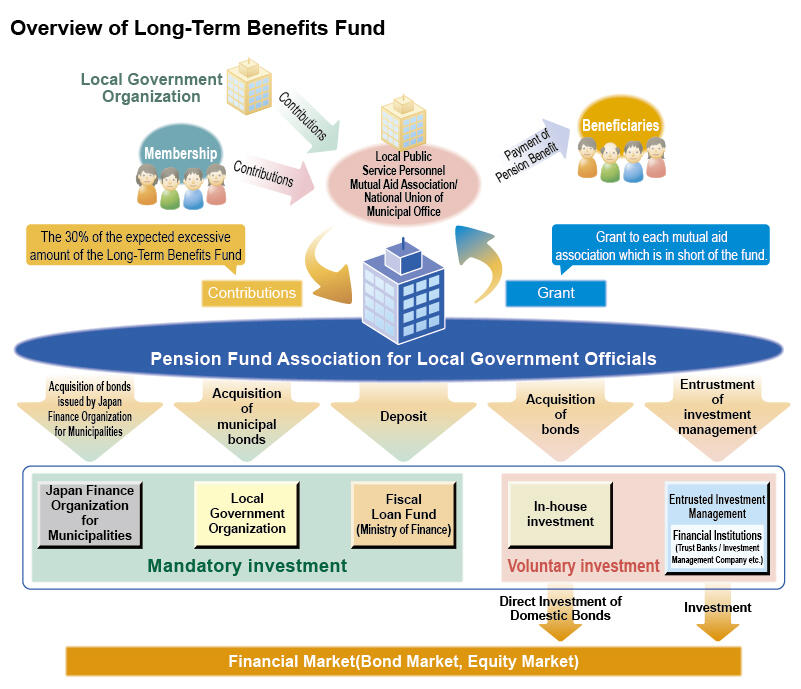

The Association sets aside and manages a pension reserve fund so that the pension benefits plan of mutual aid associations will be operated smoothly. In the event of a shortfall in resources to fund pension benefit payments of mutual aid associations, the fund is to provide the necessary amount to cover it.

The long-term benefits fund, which was built up and administered by the Association before the integration of employee pension plans, increased year by year to 18,445.6 billion yen as of the end of 2014, driven by, among other factors, annual paid-in amounts equivalent to 30% of expected increases in pension funding from Association members and investment income.

* Paid-in money from mutual aid associations

If the income (e.g., contributions) to each mutual aid association exceeds its expenditures (e.g., benefit payments) in any fiscal year, the 30% of the excessive amount is to be paid to the Association. If the mutual aid association's income is below its expenditures, it will draw on its long-term benefits fund to fund benefit payments. In this case, no money will be paid to the Association.

2 Pension Fund Administration and lnvestment after Integration of Employee Pension Plans

Mutual aid pension for public employees that included occupational portion (third-tier) had been operated as part of the public pension system. After the integration of employee pension plans, public employees participate in the Employee Pension Insurance (EPI) system, sharing the same system with the private sector employees. While the Association continues to operate the fund, the first- and second-tier portions are now public pension EPI, and the third-tier portion is composed of "former occupational portion (transitional long-term benefit)" (former third-tier) and "annuity retirement benefit" (new third-tier).

The mutual aid pension fund has been divided into the EPI portion and the former third-tier portion, and the building of a new fund for the new third-tier portion has started.

The government establishes basic rules titled "Fund Basic Guidelines" for the administration and investment of the EPI portion of fund, and the administration and investment entities jointly create "asset mix targets for funds (model portfolio)," setting forth target allocation of assets (domestic bonds, domestic stocks, foreign bonds and foreign stocks) for the investment of reserve funds.

In line with these, the Association administers and invests funds by establishing the Administration and Investment Policy, which stipulates the asset mix (benchmark portfolio) and other basic rules for administering and investing reserves funds for local public service mutual aid associations as a whole, and the Basic Policy, which stipulates basic rules for administering and investing the Association's reserve fund. (The Fund Basic Guidelines and model portfolios are not established for the former and new third-tier portions).

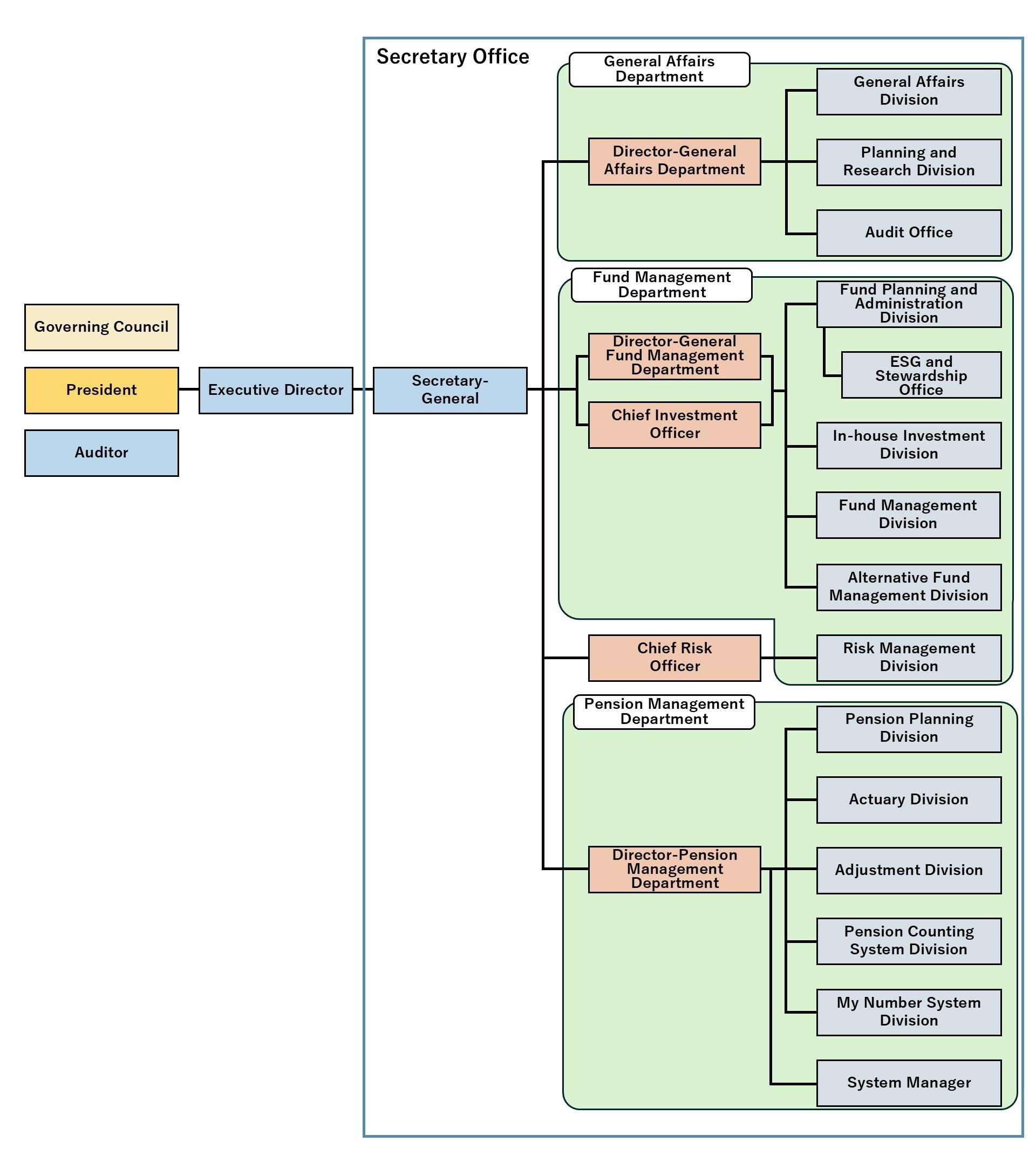

Organization Chart

Access

Pension Fund Association for Local Government Officials

1-1, Uchisaiwaicho 2, Chiyoda-ku, Tokyo 100-0011 Japan

Fund Planning & Administration Division

Tel: +81-3-6807-3677

Fax: +81-3-6807-3693/3694